2023 Energy Market Review + 2024 Preview

Following the tumultuous year that was 2022, when prices increased to levels barely believable a few years ago, the Winter 23 gas and power contracts spiked to above 700p/therm and £575/MWh respectively, thankfully the UK received some much-needed respite.

During the Winter of 2022/23 there were real concerns that Europe may run out of gas due to a dramatic decrease in Russian gas flows, low gas storage levels and continuing issues with nuclear generation in France.

Thankfully, however, we avoided the worst of this crisis due to decreased industrial and domestic demand, strong Liquid Natural Gas (LNG) deliveries and generally warm and windy weather conditions which significantly softened short-term pricing.

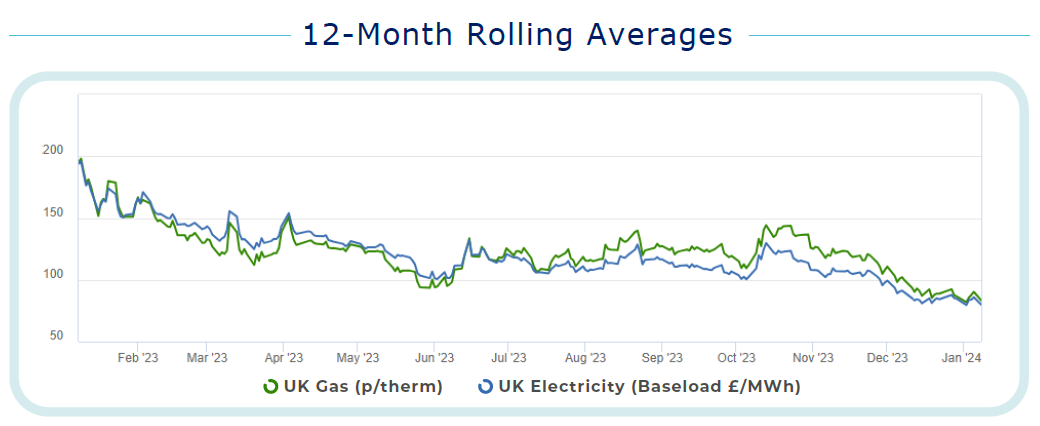

Longer-term markets were quick to follow this bearish momentum and 2023 – for the most part – saw a steadily decreasing market. From around the start of Spring 2023, the markets enjoyed a period of low volatility, with global markets slowly adapting to the changing dynamics: lower Russian flow being balanced by increased LNG deliveries.

While October saw a brief return to volatility, with prices increasing on the back of fears of a long, cold winter and further reductions in gas flow from both Russia and the Middle East due to the escalating geopolitical crisis, thankfully this has – so far – been short-lived.

Having come through the first half of Winter 23 relatively unscathed, excusing the week-long cold snap in late November and a cold start to January, prices are again in a bearish trend due to milder and windier forecasts for the second half of the month.

This should leave gas storage levels at record highs and is sending gas and power prices down significantly: Summer-24, at the time of writing, is trading at 76p/therm for gas and £73/MWh for power, with the Winter-24 contract at 93p/therm and £89/MWh, which highlights the hugely changed landscape from where we were this time last year.

2024 Energy Market Outlook

As much as we would all like to see this downward trend continue, there do remain some significant upside risks: concerns persist about the impact of the Middle East crisis on LNG deliveries (although Qatar only supplies around 5% of Europe’s LNG) and the possibility of cold weather in the second half of the winter.

However, with increased LNG deliveries from the US following the Panama Canal restrictions, reductions, or delays in imports from the region shouldn’t lead to a significant increase in prices, especially considering the expected weak economic conditions which should keep energy demand well below pre-war levels.

Having said this, with energy markets, often the biggest risks are the ’unknown unknowns’, the market events that we do not yet know about, so energy buyers should strongly be considering the opportunities currently available, especially in light of the recent history where prices moved to levels simply unaffordable for many businesses.

At current price levels, many buyers of both fixed and flexible contracts would be looking at a significant reduction in cost relative to their existing contracts and hedges in place and should be strongly considering looking to bank some of the recent falls in market prices and hedge against a potential return to bullish markets if we were to see further gas flow interruptions or bullish market drivers.